Petco Health and Wellness: An Attractive Prospect For Pet Lovers

FatCamera/E+ via Getty Images

Any dedicated pet owner understands that your pet becomes a member of your family. And just as you would with a family member, you want to make sure that your pet has all that it needs in order to live a happy, long, and productive life. Today, there are a few publicly traded companies dedicated to making this goal a reality. One such firm is Petco Health and Wellness Company (NASDAQ:WOOF). Over the past few years, the management team at Petco Health and Wellness has done well to grow the company’s top line. Bottom-line performance, while mixed, has generally been positive as well. At first glance, shares look perhaps slightly pricey from an earnings perspective if we use data from 2021. But when we look at projections for 2022, the company looks quite affordable. There is some concern about the broader economy, as well as a step-up in competition from Amazon (AMZN). But so long as the business continues to achieve the kind of performance that it has, upside moving forward could be appealing.

A Pet-Centric Business

Operationally speaking, Petco Health and Wellness has been around for more than 55 years. But over the past few years, the business has really worked to transform itself from a traditional retailer to an omnichannel provider of pet health and wellness offerings. Today, the company provides over 24 million total active customers with a diverse and differentiated portfolio of products and services aimed at maximizing pet health and wellness. These products and services are made available through over 1,500 pet care centers spread between the U.S., Mexico, and Puerto Rico. The company also has a digital channel through which offerings are provided.

Service offerings the company provides include veterinary care, grooming, and pet training. The company does this, in part, through more than 1,000 weekly mobile clinics that it runs in the regions in which it operates. The firm also operates 197 full-service veterinary hospitals, with the plan of eventually expanding this to roughly 900 at some point in the distant future. On top of this, the company provides what it calls its Vital Care membership program. This program costs $19.99 per month and includes benefits like 20{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} off every pet groom, 10{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} off on all nutrition products, an extra 5{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} off on nutrition products if you sign up for repeat delivery, $20 off pet boarding, dog walking, or pet sitting services, $15 of Pals Rewards every month, and unlimited routine vet exams at any and all Vetco Total Care locations. For free, customers can also sign up for the company’s Pal Rewards loyalty program.

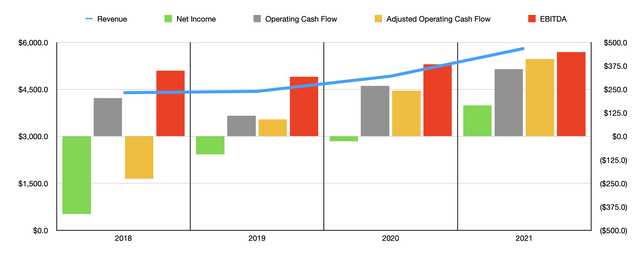

Author – SEC EDGAR Data

Over the past few years, the management team at Petco Health and Wellness performed well when it came to growing the company’s revenue. Sales increased from $4.39 billion in 2018 to $5.81 billion in 2021. The strongest growth for the company came from 2020 to 2021 when sales skyrocketed 18{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} year over year. Interestingly, this growth in sales from 2020 to 2021 came at a time when the number of pet care centers the company has in the US and Puerto Rico dropped from 1,454 to 1,433. Instead, the company really benefited from two things. First, it experienced an 18.9{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} rise in comparable sales. This was on top of the 11.4{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} increase in comparable sales the business experienced from 2019 to 2020. Second, the business saw the number of veterinarian practices it operates increase, with that number climbing from 125 to 197. The strongest growth for the company for the year came in the services and other category, where revenue jumped an impressive 43.2{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} thanks in large part to the firm’s growing veterinary hospital business and because of additional pets coming into its network. By comparison, supplies and companion animals grew by a more modest 11.8{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86}, while consumables sales jumped by 19.3{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86}.

Over the same four-year window, the net profits for the company improved markedly. The firm went from generating a net loss of $413.8 million in 2018 to generating a profit of $164.4 million last year. Operating cash flow has also generally risen, climbing from $203.2 million in 2018 to $358.2 million in 2021. If we adjust for changes in working capital and non-cash lease costs, the improvement was even greater, with the metric climbing from negative $226.6 million to a positive $411.4 million. Meanwhile, EBITDA for the business also expanded, rising from $349.2 million to $448.9 million.

When it comes to the 2022 fiscal year, management has some high expectations for the business. Revenue is expected to be between $6.15 billion and $6.25 billion. The company is also forecasting adjusted earnings per share of between $0.97 and $1. At the midpoint, this would imply net income of $263 million. On top of this, EBITDA should be between $630 million and $645 million. If we assume that adjusted operating cash flow will grow at that same rate, then it should be around $584.2 million for the year.

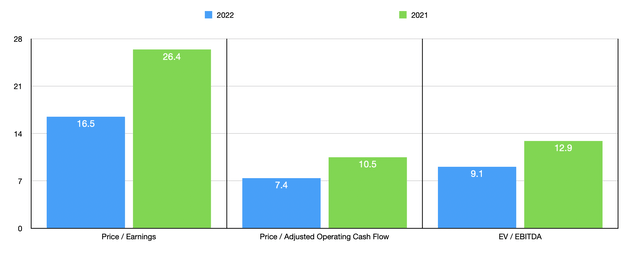

Author – SEC EDGAR Data

Taking this data, we can easily value the company. Using our 2021 results, we can see that the business is trading at a price-to-earnings multiple of 26.4. This drops to 16.5 if management’s forecast for the year is correct. The price to adjusted operating cash flow multiple should be 10.5, a figure that should drop to 7.4 if we use 2022 estimates. And the EV to EBITDA multiple should be 12.9. This should ultimately drop to 9.1 if management’s forecast is correct. To put the pricing of the company into perspective, I compared it to five other pet-oriented businesses. On a price-to-earnings basis, only three of these companies had a positive result, with the multiples ranging from 15.4 to 2,198. Using our 2021 and 2022 results, two of the three companies were cheaper than Petco Health and Wellness. Using the price to operating cash flow approach, the range for these companies was from 11.3 to 6,962. Whether we use the 2021 or 2022 numbers, our prospect was the cheapest of the group. Finally, using the EV to EBITDA approach, the range was from 10.6 to 3,813. Using the 2021 data, two of the five companies were cheaper than our target. And using the 2022 estimates, our prospect was the cheapest.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Petco Health and Wellness Company | 26.4 | 10.5 | 12.9 |

| Chewy (CHWY) | 2,198 | 52.5 | 285.4 |

| Freshpet (FRPT) | N/A | 6,962 | 3,813 |

| Central Garden & Pet Co (CENT) | 15.4 | 23.4 | 10.6 |

| PetMed Express (PETS) | 19.0 | 21.7 | 11.0 |

| PetIQ (PETQ) | N/A | 11.3 | 17.2 |

At this point in time, shares of the company look rather attractive on a forward basis. However, there are broader concerns about the state of the economy, and one of the first areas people will cut back on is pet spending. However, the business still continued to grow its revenue during the pandemic. So I don’t see the impact there being all that great. Perhaps the bigger concern for investors is the fact that Amazon recently held its first-ever Pet Day event, with deals across pet, home, and electronics products. Prime members were eligible for 10{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86} cash back on pet products, and the company sold an estimated 240 different SKUs in key items across categories at an average discount of 26{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86}. Some of these products were sold at discounts of up to 40{95b18eb6fc4f42efd0d92738dfc3fb79fde21da267a711ecdf0381147c27bb86}. Truth be told, it is too early to tell if there will be any long-term damage to companies like Petco Health and Wellness. But with a $119 billion addressable market, there is likely plenty of room for multiple winners.

Takeaway

Based on the data provided, Petco Health and Wellness seems to be a really quality company that is doing well to grow its top and bottom lines. I understand that there is some concern about the company in the near term. But long term, I suspect the business will do just fine. Interestingly, the firm is slated to report financial results covering the first quarter of its 2022 fiscal year on May 24th. Investors should pay careful attention to that and see what kind of revisions, if any, might need to be made to management’s guidance. But absent a significant change in expectations, I do believe the company offers some attractive opportunities for value-oriented investors.